Analytics Software Enhances Insurer’s Ability to Resolve Claims Faster

Johannesburg, South Africa – 09 May 2012: IBM today announced that Santam, South Africa’s leading short term insurance company, has saved $2.4 million on fraudulent claims in the first four months of using IBM business analytics software. The analytics software has enhanced Santam’s fraud detection capabilities and also enabled faster payouts for legitimate claims.

“IBM and OLRAC-SPSolutions have helped us build a solution that has not only transformed our claims processing methodology in terms of speed and efficiency, but also provides new insight which helps us identify false claims more quickly, which protects our business and customers,” said Anesh Govender, Head of Finance, Reporting and Salvage at Santam. “The solution has delivered a full return on investment and also helped uncover a motor insurance fraud syndicate in less than 30 days after the system went live.”

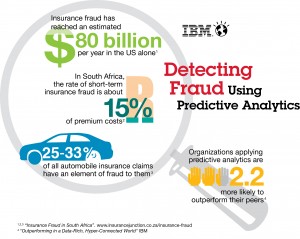

Insurance organizations are using predictive analytics to detect fraud. For example, Santam, South Africa's leading short term insurance company, has saved $2.4 million on fraudulent claims in the first four months of using IBM business analytics software. The technology is enabling faster payouts for legitimate claims. Image credit: IBM

The claims division developed a new operating model for processing claims, depending on varying risk levels. IBM’s predictive analytics software has enabled Santam to automatically assess if there is any fraud risk associated with incoming claims and allows the insurer to distribute claims to the appropriate processing channel for immediate settlement or further investigation, which optimizes operational efficiency.

With the enhanced claims segmentation, Santam is also able to reduce the number of claims that need to be assessed by mobile operatives visiting the customer or claim site, resulting in further considerable cost savings for the company.

Speed of claims handling is an important differentiator for the company. Before using IBM analytics, it took at least three days to settle claims. Now, Santam is able to settle legitimate claims within an hour allowing the insurer to significantly improve customer service.

“IBM is investing in building business analytics solutions that help organizations to effectively mitigate risk,” said Rich Holada, vice president of predictive analytics at IBM. “Santam provides an excellent example of how insurers can put analytics into action in order to reduce fraud and risk, while improving the customer experience by settling claims faster and keeping premiums low.”

In the last five years, IBM has invested more than $14 billion in acquisitions. With investments in SPSS, Clarity, OpenPages, i2 and Algorithmics, and others, IBM is building business analytics solutions providing clients with capabilities for managing fraud, risk and threat. In addition, IBM has assembled almost 9,000 dedicated analytics consultants with industry expertise, and created a network of eight global analytics solution centers.

The Santam project illustrates IBM’s leadership in analytics in South Africa. IBM is also actively laying the foundations for a major presence throughout the African continent, with offices in more than 20 African countries, where the company is assisting businesses and governments in building strategies, expertise, solutions, frameworks and operating procedures to help improve performance.

The IBM predictive analytics solution at Santam was implemented by IBM Business Partner, OLRAC-SPSolutions.

*Source: IBM